Credit Cards

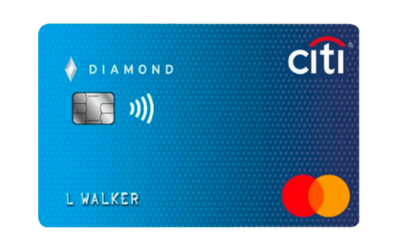

See how to request the Citi Secured Mastercard® Credit Card

Now that you've seen all the advantages and disadvantages of the Citi Secured Mastercard credit card, it's time to find out how to apply once and for all. Keep reading and see everything about it.

Advertisement

Learn how to apply for the Citi Secured Mastercard, the card that will help you build your credit score!

Today, in this article, we are going to tell you how you can apply for your credit card, Citi Secured Mastercard, in an easy, simple and practical way. After all, this credit card can represent a good opportunity for people who want to build their credit history.

It is also important to point out that we are going to tell you if it is really worth asking for this credit card. All this taking into account that nowadays there are several credit card opportunities and it is important to know how to define which are the best options within your needs and expectations.

That is, at the end of this article you will be able to understand how you can order your card in the easiest way. And also understand if he really is a good option for you right now. Our goal is to provide a simple and detailed analysis to help you make good financial choices.

And if you’re looking for an option to help you build your credit and upgrade to other cards later, read on and find out how to order yours!

How to apply for your Citi Secured Mastercard

Now that you know what the requirements are, it’s time to understand how you can apply for your Citi Secured Mastercard credit card. However, it is necessary to know that the entire process can be done online. Which means you won’t need to go to a bank branch to make your request.

However, at the time of the application it is important that you have personal documents and proof of residence at hand. As well as proof of income. And you will have to wait for an analysis of your registration, after all, a credit check will be made. Because this card is more suitable for people who have average or good scores.

From this, know that you will have to make the security deposit. In this case, you need to have $200 for the deposit, or up to $2,500. And this deposit must be made within 14 days of opening the account. Once this is done, your available credit limit will correspond to your initial deposit and just wait until your card arrives at your residence.

You will be redirected to another website

You’ll receive messages for less than 1 week, with a maximum of 1 message per day. You can unsubscribe anytime by replying STOP. By submitting this form, I confirm that I am 18+ years old and agree to the Privacy Policy and Terms and Conditions. I also provide my signature, giving express consent to receive marketing messages via automated emails, SMS, MMS text messages, and other forms of communication. Message frequency may vary as part of our good-faith effort to respond to your inquiry. Message and data rates may apply. Text STOP to cancel. I understand that my consent to receive communications is not a condition of purchase and that I may revoke my consent at any time.

Is the Citi Secured Mastercard credit card a good choice?

As promised, we’ll give you a full review. Whether the card in question is worth it or not. From this point, it is important to know that this card is a little different from other credit cards that have a guarantee. That’s because it is indicated for those who have a medium or good credit score, because if you have a bad credit score, you will probably not be accepted on this card.

Which is quite different compared to other credit cards, with guarantees that are generally more suitable for people who have a below average credit score. However, this card can be a good advantage as it does not charge any annual fees and reports to the top 3 credit bureaus today.

However, as we are giving a true and unbiased review. It is important to know that this credit card, compared to other cards that have a guarantee, may not offer many advantages. Especially taking into account the fact that you must pay the initial deposit mandatorily within 14 days after opening the account. And this can be a little harmful for people who are unable to offer this deposit in this period of time.

Finally, if you don’t have a very good credit score, the Citi Secured Mastercard might not be the right option for you. But if your score is average or good, it might be worth asking for this card!

Also check out Capital One Quicksilver

If you are looking for another secured credit card option that offers advantages to users, we can recommend you a good option. For this, you just need to click on the button below, and you will have access to all the important information about the Capital One quicksilver credit card.

Capital One Quicksilver

Find out all the advantages, disadvantages and requirements for applying for your Capital One Quicksilver credit card!

Trending Topics

Lightstream Personal Loan: Learn More

Learn about the advantages and disadvantages of taking out a loan with Lightstream Personal Loan, and much more!

Keep Reading

Review of the Fortiva Mastercard® credit card

Find out in this article what are the requirements, advantages and disadvantages of the Fortiva Mastercard credit card!

Keep ReadingYou may also like

See how to request the Premier Bankcard® Credit Card

Would you like to know the best card ever? Premier Bankcard is here to make your life easier than ever! See how to apply.

Keep Reading

5 ways to improve your credit score: get these easy tips

If you're looking for ways to improve your credit score, you're in the right place. This post has the perfect tips to build an excellent one!

Keep Reading